ROA

- How profitable a company is relative to its total assets.

- Effective while comparing similar companies and checking past performance.

- Company's debt, taken into account

- Higher the ROA number is the better

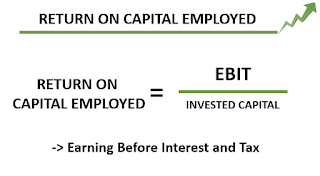

ROCE

- Sum of shareholders equity and debt liabilities.

- Profit generated by each rupee employed

- Depends on comparing with historical ROE & Industry Peers.

- Thumb Rule is anything less than broader index avg is poor.

- Extremely high ROE is risk

- High ROE is excess debt

0 comments:

Post a Comment